Alternative Credit at the Neighborhood Level

For low-income residents, who either lack a traditional credit history or suffer from bad credit, the inability to demonstrate credit-worthiness can serve as crippling barrier to financial freedom and upward mobility. Alternative credit reporting attempts to bridge the current gap in the marketplace that exists for countless Americans for whom traditional credit reporting fails to benefit or ignores.

Overview

In 2015, OFE and Urbane selected the neighborhood of Bedford-Stuyvesant in Brooklyn to anchor their alternative credit research in place and to begin building a framework that is replicable and provides actionable insight to the public, private and nonprofit institutions working in this space.

Office of Financial Empowerment (OFE)

2015

Mixed Methods Research

Data Visualization

Strategic Policy Recommendations

Synopsis

The persaviness of bad credit in the United States is staggering, and in light of this credit crisis, the Office of Financial Empowerment (OFE), the first local government initiative in the nation whose mission is to help low-income individuals build assets and maximize their financial resources, partnered with Urbane to identify “alternative” credit as a means for underserved communities to access more traditional financial services.

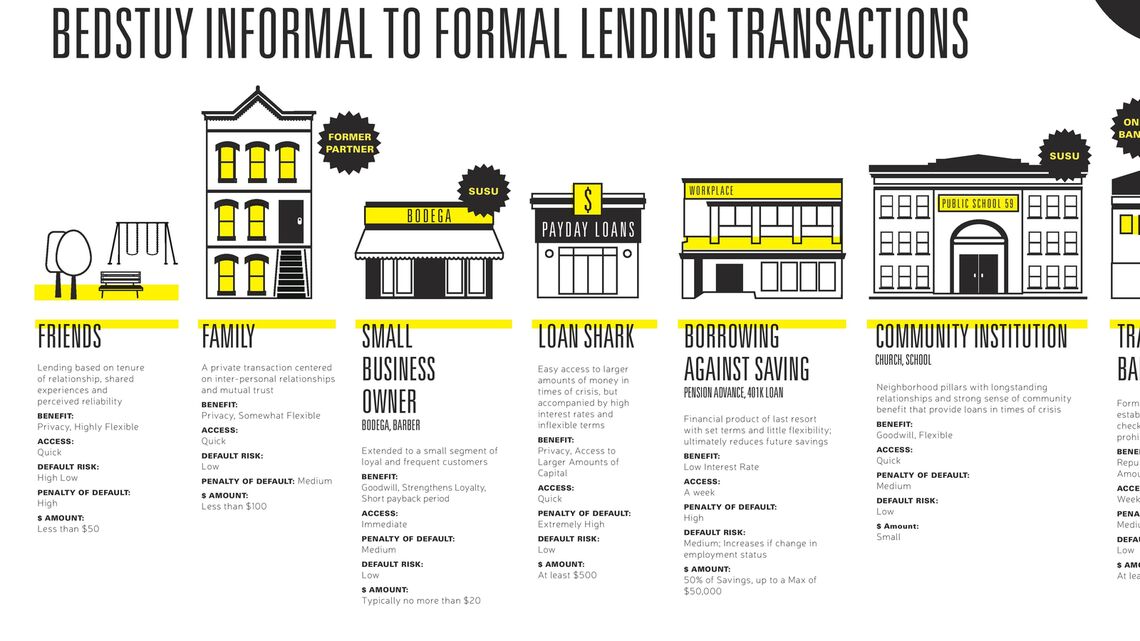

Bedford-Stuyvesant ("Bed-Stuy") has a rich cultural history and legacy with strong community stakeholders, and is a reflection of the diversity that strengthens the fabric of the City. Like many neighborhoods in New York City and the nation, Bed-Stuy continues to deal with increased price pressures from new housing developments that make it vulnerable as an affordable place for low- to moderate-income residents. This in turn positioned Bed-Stuy as an ideal candidate for further exploration as it relates to alternative credit reporting and potential implementation.

To understand the financial challenges faced by residents and opportunities within the neighborhood, Urbane met with a number of trusted local institutions, including Bed-Stuy Gateway Business Improvement District (BID) and Bedford Stuyvesant Restoration Corporation (Restoration), both agencies that have valuable insights into the power dynamics of lenders, businesses, and consumers at the neighborhood level.

Leveraging the networks of its partners, Urbane conducted group interviews and focus groups with the Financial Empowerment Center Counselors and consumers to understand broad level trends and to begin connecting the issue to the neighborhood context. This was supplemented with numerous touchpoints with experts in the field, municipal agencies, and banking and lending institutions, all indidivuals and organizations that have a unique perspective on financial trends they have observed in underserved, minority communities and can speak to the viability of targeted initiatives to take root and transform neighborhoods like Bed-Stuy.

Partner referrals also resulted in surveying 25 small businesses with a special emphasis on grocery stores, health and beauty retailers, food services and restaurants, and dollar stores. These interactions soldified the importance of "trust," not only as a referral mechanism that had higher efficacy, but also as a central tenet of the fabric of a neighborhood. Credit born of trust in part or whole, and afforded by local businesses to residents, allowed those with limited or nonexistent access to traditional credit products a means of meeting their basic needs and that of their loved ones.

Check out the full infographic we produced here.

Epilogue

Since the production of our final report in 2015, the field of alternative credit has grown robustly. From positive rent reporting to prompt rental and child support payments, there has been substantial growth in the appetite of major credit bureaus to acknowledge and utilize alternative data points that are more equitable and pertinent to the lives of many LMI individuals, including those that reside in Bed-Stuy. We're excited to continue to partner and explore alternative modalities that support the social and economic mobility of those mose adversely effected by bad or limited credit.